State lawmakers recently questioned Hawaiʻi Pacific Health and insurance provider HMSA about their proposed plan to create a nonprofit parent organization called One Health Hawaii.

The joint briefing Tuesday included the state’s other health insurance and health care providers. Many raised concerns about how the partnership would impact competitive markets, access to care, and client balances at health systems.

“For some of us as independent providers, the surrounding discussion of the affiliation makes it seem like we could be inconsequential in the decisions that are made. But that decision on how this moves forward is extremely consequential,” said Adventist Health Castle President Chase Aalborg.

“If it is not managed correctly, independent providers could feel the heaviest of impacts. The ripple effect through the community could be incredibly painful.”

The Hawaii Medical Assurance Association, a smaller health insurer in the state, was also concerned that the partnership would increase costs for residents due to a consolidation of services.

“Once consolidation increases leverage and reduces competition, price increases can occur gradually, internally, and without clear accountability. Voluntary commitments are difficult to monitor, difficult to enforce, and often expire as leadership and circumstances change,” said Hawaii-Western Management Group President Paul Kaiser, representing HMAA.

“Hawaiʻi faces irreversible risk. This transaction represents a one-way door. If approved, it would be extremely difficult to unwind even if premiums rise and competition deteriorates. Hawaiʻi's small and geographically isolated market offers no realistic alternative networks to absorb pricing errors or failed integration.”

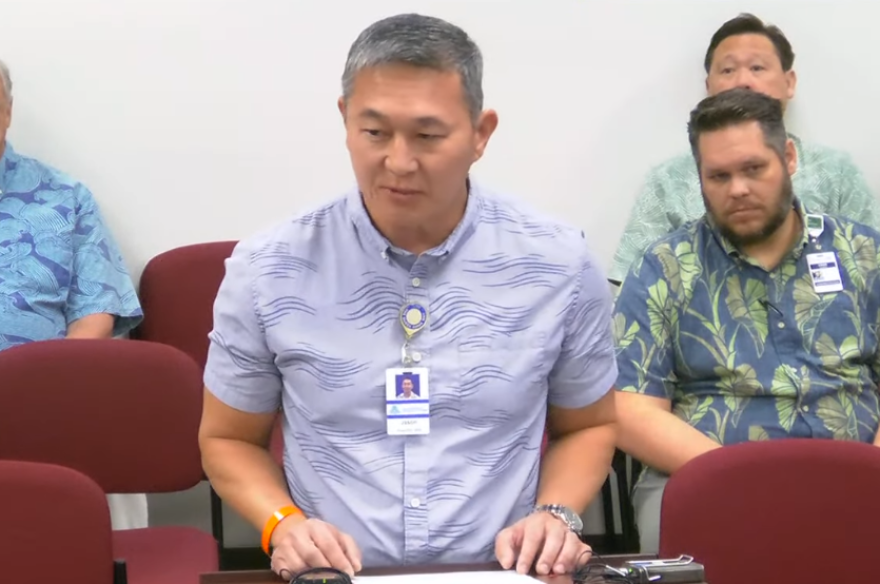

However, Hawaiʻi Pacific Health President Ray Vara said that the partnership would alleviate administrative burdens on both HPH and HMSA.

He said it could result in billions of dollars of cost savings over several years, which they said they plan to put into three different investments: lowering insurance rates, reinvesting into the state’s health care system like adding more specialty doctors on neighbor islands, and funding social determinants of health such as education and workforce development.

“What you haven't heard us talk about in any forum, and not here today, is somehow how this is good for Hawaiʻi Pacific Health or HMSA. What you've heard us refer to is why this is good for Hawaiʻi and sustainable health care services that bend the cost curve and provides high-quality, accessible care for the people of Hawaiʻi,” Vara told lawmakers.

“With that in mind, there is no marker of success in which there is a wounded Queen's, a wounded Castle, a wounded [Hawaii Health Systems Corporation], and those providers that provide the most vulnerable services alongside the Hawaiʻi Pacific Health in a safety net capacity.”

Vara told lawmakers that it would be “a practical impossibility” for the partnership to result in “large-scale shifts” in commercial clients leaving safety net hospitals like Queen’s, which would result in significant revenue losses and threaten existing services.

“Smaller level shifts happen on a daily basis already. Patients choose what providers they go to and they choose then what health system they work with,” Vara said. “Those shifts will continue. But the beauty of having this umbrella under a not-for-profit organization is any value creation gets reinvested into the well-being of our community, consistent with the mission, which is to create a healthier Hawaiʻi for generations to come.”

However, Queen’s Health Systems President Jason Chang emphasized that a 1% loss of commercial patients amounts to $9 million.

“There are certain services that Queen's provides that we will never stop: behavioral health services, trauma, stroke, those types of services that the community always relies on Queen's to provide,” he said.

“The concern is that the shifting of some of the core services, because there are very lucrative services that provide the revenue to allow you to fulfill your mission, and if you start to impact those core services, you have to make some hard decisions."

House Consumer Protection and Commerce Committee Chair Scot Matayoshi explained that this is just the beginning of legislative discussions about the proposed partnership, although the Legislature itself does not need to approve the partnership.

“I think our role is to make sure that we convene the parties to get the kind of information we need to get to the public and so the public can better understand what process is going on here,” Matayoshi said. “We do plan to have an additional informational briefing once more details come out, especially once the filings come out, to ask more specific questions once we understand the structure of the deal going on.

HPH and HMSA will need to complete several regulatory steps before the partnership is finalized — including approval from state agencies, the Federal Trade Commission, and the U.S. Department of Justice.

HMSA and HPH have not yet submitted any regulatory filings needed to approve the partnership.

Over 750,000 people in the state use HMSA as their insurer. The Hawaiʻi Pacific Health system includes four flagship hospitals: Pali Momi, Straub Benioff and Kapiʻolani on Oʻahu, and Wilcox on Kauaʻi.

Hawaiʻi Public Radio exists to serve all of Hawai’i, and it’s the people of Hawai’i who keep us independent and strong. Help keep us strong to serve you in the future. Donate today.