While negotiations over additional federal assistance to cities and states remain deadlocked, Hawaii’s chief executive says the state may be forced to furlough workers in the coming months if Congress fails to act.

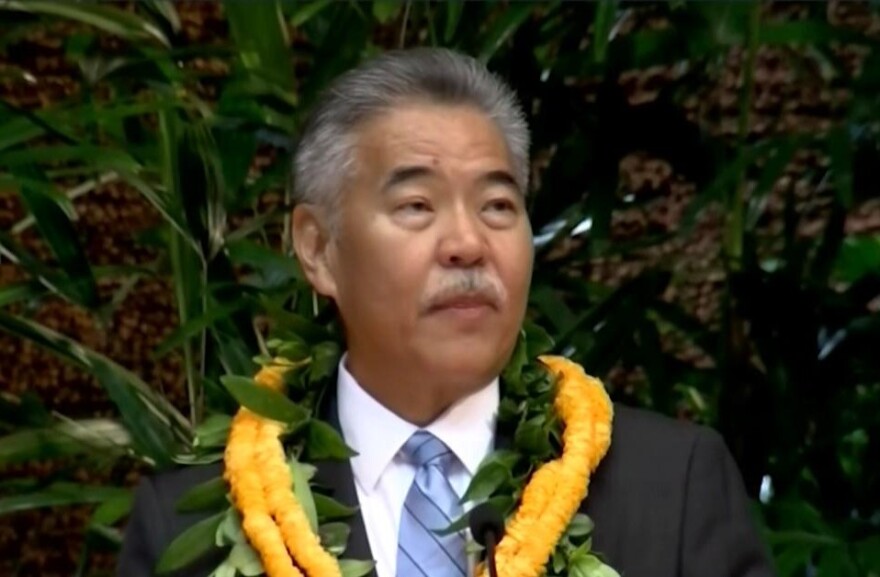

When it comes to the state’s finances, Governor David Ige is not pulling any punches. He says the state needs at least $1 billion from the federal government or it may have to consider cutting state programs or reducing workforce expenses.

We need to get additional federal aid or else we will have to take dramatic and decisive action to deal with our budget crisis,” Ige said in an interview with HPR.

Over the next two years, the state is facing a projected budget shortfall of $2.3 billion. The governor says tax revenue coming in to state coffers has already dropped by 25%.

Hawaii is hardly unique in that situation. A nationwide reporting project by NPR found that states across the country are seeing massive declines in revenue. Ige among the chorus of state governors asking Congress to provide more money to cash-strapped states.

Hawaii already received more than $1 billion dollars in grants from Washington as part of the CARES Act rescue package, but that money came with a lot of restrictions. It could only be used to pay for new and unexpected expenses related to the pandemic. Hawaii has used the money to fund programs like health screening at airports or rent assistance for workers who were laid off.

However, now the state needs money to pay for normal operating expenses, which cover everything from invasive species control to homeless outreach services. Ige says the state needs at least $1 billion to avoid substantial cuts.

“The new funds we would seek, would allow us to replace lost revenues and fund core, existing programs that our community needs right now,” the second-term governor said.

Another option is to borrow that money. State lawmakers already gave Ige approval to take out some 2 billion in loans from the Federal Reserve’s Municipal Liquidity Facility.

However, borrowing is seen as less desirable than a grant from Congress. Loans from the U.S. central bank are not free; the Fed charges interest. With so much uncertainty about the state economy and future revenue, the state has to be careful not to overextend its ability to repay borrowed funds.

Hawaii currently enjoys a strong AA+ credit rating, which makes financing large municipal projects much cheaper. An overreliance on borrowing to plug the budget hole could lead to a lower credit rating, making it more difficult and costly to finance major public works projects.

Governor Ige’s financial plan currently includes between $700 million and $1 billion in borrowing. But he cautions that would only temporarily prevent furloughs or layoffs, which he euphemistically refers to as “labor savings”, if further federal money is not approved.

If Congress fails to act, that decision would likely have to be made by November according to the Governor.

Many Republicans in Congress have long said they OPPOSE providing money for states to fund pre-existing expenses, which they call a bailout. On Wednesday, Senate Majority Leader Mitch McConnell described such a program as a “slush fund.”

On the same day, Treasury Secretary Steven Mnuchin and White House economic advisor Larry Kudlow doubled down on that assessment, saying the Trump Administration would not approve funds to bail-out state pensions fund or “bad management.”

However Mnuchin did signal some openness to providing increased flexibility in how states and cities are allowed to use relief funds.