State Lawmakers are considering legislation to revamp how tourism taxes are distributed to the counties.

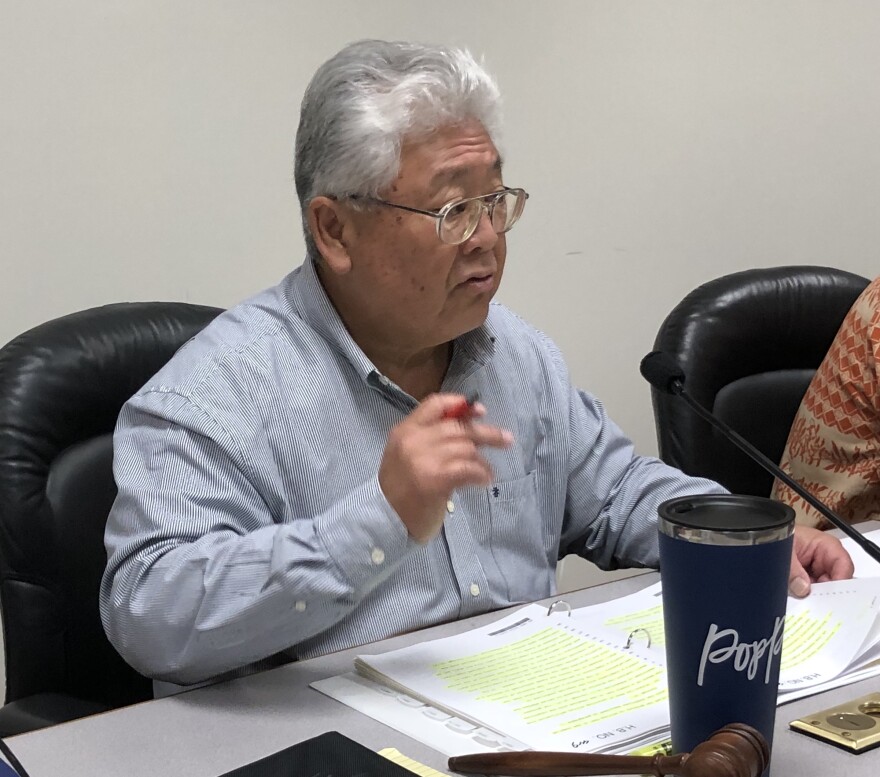

House Bill 983 would provide 23.1 percent of the Transient Accommodations Tax or TAT to the Counties. Kaua’i County would receive 14.5 percent of that amount, Hawai’i County 18.6, Maui 22.8 and the City and County of Honolulu 44.1 percent. House Committee on Tourism and International Affairs chair, Representative Richard Onishi, says the TAT proposal is a double edged sword…

“It’s an amount that will fluctuate depending on the industry. So, the proposal to change it to a percentage has that potential of reducing the minimum that the counties would receive annually. Anybody who works on a budget, they’d rather have a steady stream of income because then they can adjust their expenses to that income.”

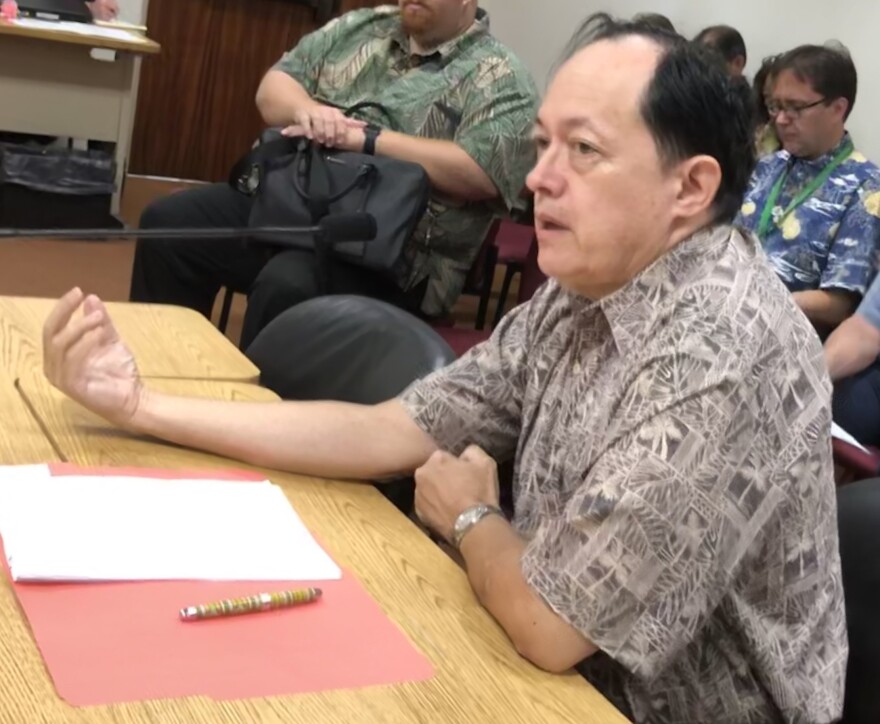

The TAT would also fund state programs to preserve and protect natural resources, fund convention center activities and provide for a tourism emergency fund. Tax Foundation of Hawai’i president, Tom Yamachika, says the proposal is too complicated.

“I’d like to just give you an example that illustrates this. It’s from a Senate bill and it had pages and pages of earmarks. It looked like a budget bill. We don’t wanna have two budget bills. We already got one and that one’s long and complicated enough. We certainly don’t need another one. That’s kind of why we are concerned about the proliferation of earmarks on taxes such as this one.”

House Bill 631 would allow each County to establish its own surcharge on the TAT. Kaua’i County Councilmember, Felicia Cowden, supports the proposal because she says the island is being overrun by visitors.

“Places like Hanalei, in the daytime, it’s probably 50 percent of the people on the street are on vacation. And, in an area like Haena, which is now closed, the community there, after having the trauma of the floods, many of them have almost really welcomed all that trauma because they finally have their privacy and sense of community.”

The rates have not been set in the bill, but one option, would be to cap the State’s share at 7 percent and allow each County to set its own percentage on top of that. Representative Val Okimoto voted “no” on the measure.

“I’m opposed to tax increases and a surcharge, it may significantly increase the cost of hotel rooms and I do believe, that when it comes to the TAT, we should stick to what it was designed for; to help the counties address their needs instead of us as the state legislature, seeing it as a fund that we can dip into to address our concerns.”

The state collected more than 600 million dollars in TAT last year and the TAT rate went up January 1st one whole percentage point…to 10.25 percent. Wayne Yoshioka, HPR News.