There are bills moving through the legislature in both houses that aim to tax currently exempt corporate businesses.

Since their creation in 1960, Real Estate Investment Trusts or REITS, have been exempt from paying state corporate income taxes. REITs distribute 90 percent of their taxable income to their shareholders in the form of dividends, which are tax deductible. Local developer, Peter Savio, says REITS should pay their fair share by plugging the tax loophole.

“We’re losing $60 million, minimum a year. Possibly $120 million a year. The federal government scores. They get paid the taxes. The local taxpayer is the one who gets screwed. Your kids. Your parents. Your grandparents are being screwed and paying more taxes because we’ve allowed the REITS to cheat.”

Shareholders pay personal income taxes on their dividends. Mits Fujimura, who represents the National Association of Real Estate Investment Trusts, says Hotel REITs in Hawai’i already pay double General Excise Taxes as property owners and hotel operators.

“A REIT cannot own and operate a hotel. They have to split it and consequently, they’re paying double the GET you would normally get as a non-REIT owner. Our estimation is, annually, the state is getting and additional $16-million in GET revenues.”

But, the Faith Action for Community Equity or FACE, says REIT-owned properties in Hawai’i are valued at 18 billion dollars and earn about one billion in profits annually. Catherine Graham, co-chair of the FACE Housing Now Committee, says most citizens don’t know what REITs are.

“When they find out that the Ala Moana Shopping Center does not pay income tax to the State of Hawai’i, they’re kinda floored. That, the Hilton Hawaiian Village does not pay income taxes to us. The legislature, the state, is complaining they don’t have enough money, and yet, we’re just giving the state away.”

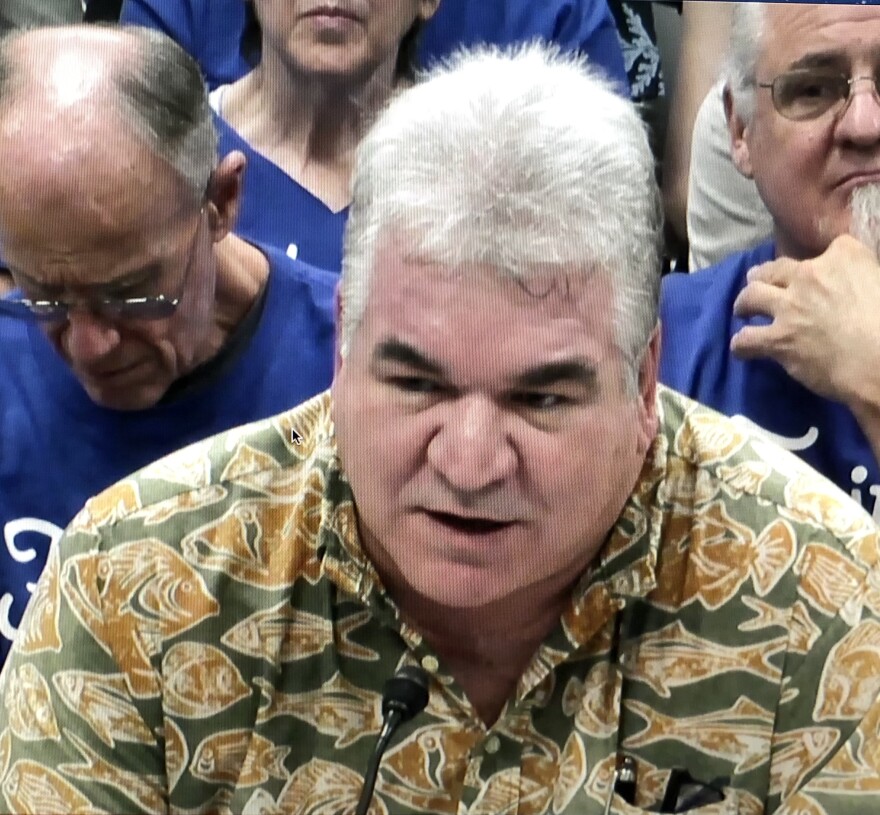

Opponents of the bill say REITs purchase long term income producing real estate and are provided tax benefits in exchange. Francis Cofran is the senior general manager for Ala Moana Shopping Center.

“REITs invest in places that help communities grow that include workforce rental housing, medical facilities, shopping centers and commercial buildings. We rent space to these spaces to local businesses. Thousands of families are supported by the jobs we create. Doing business in Hawai’i is already hard enough and this legislation will make it harder, not only for us, but also for the local families that we support.”

The Senate Ways and Means Committee passed Senate Bill 301 earlier this month. The House Finance Committee, meanwhile, will hear the companion measure, House Bill 475, Wednesday at 4pm. Wayne Yoshioka, HPR News.